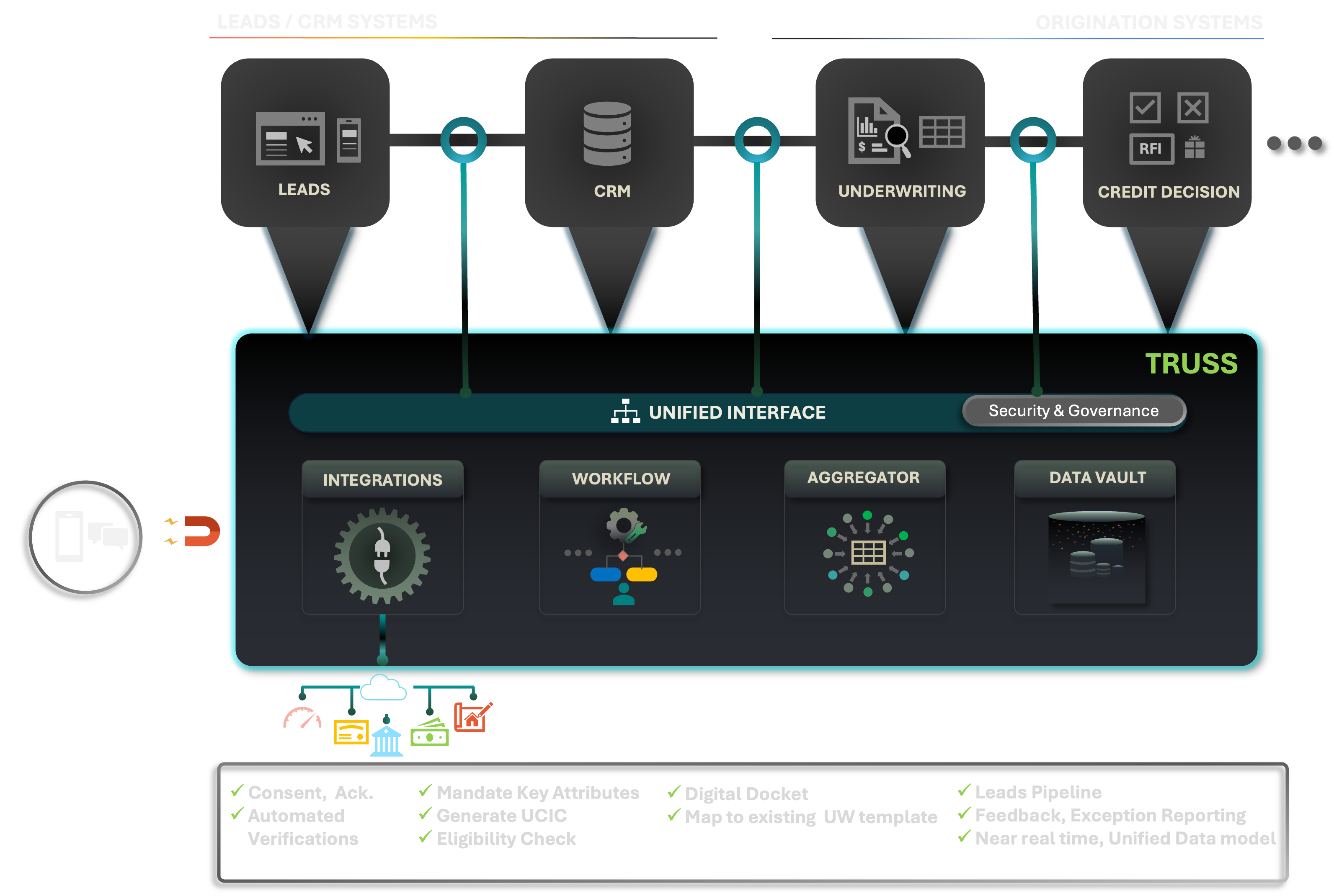

Centered around LOS; scaling application processing, reduce turnaround time while conserving resources.

Phase 1 led to designing a lean workflow with mandatory attributes for all applicants. Eliminated 44% of applications upfront without engaging advanced integration points. Reduced turnaround time for rejections, while keeping data retention formalities minimal.

4-Step Approach:

- Data Vault – Keeping clean-room ideology, deployed an in-house, cost-effective data warehousing solution which is rudimentary as well as highly scalable. Met charter for Phase 1 with real time ingestion, indexing and storage. Ensures LOS, LMS database sanctity along with contained blast radius on new initiatives. This was certified PCI, PII compliant blueprint.

- Source Consolidation – Gatekeeping influx points for applications across Web, Mobile, Agent portals and marketplaces. The primary goal was to homogenize experience and mandate attributes across all platforms to create a robust pathway for Applicant data from its source to Data Vault. In addition, allocating a Unique Customer Identification (UCIC) to track process gaps, pace, business metrics on application journeys.

- Automated Verification – Implementing primary set of integrations for I.D., Income verification. Collating verified applicants with requested loan product, amount to ensure eligibility.

- Attestation – Import, implement user preferred electronic communication. For application acknowledgement, exception reporting, disclosure statements, consent, authorization, pre-qualification and adverse action compliant rejection notification

This solution subsumed top 5 rejection criteria to enhance loan origination cycle. Additionally, met ECOA, FCRA compliance.

Pre-LMS bridge; Constructing an authenticated applicant profile by using advance integration points while managing elevated compliance in a self-managed Data Vault.

Phase 2 was designed for:

- Seamless handshake between LOS & LMS systems.

- Advance curated applicants from pre-qualification to offer stage.

- Advance Data Vault capabilities for serving future enrichment, cross-selling & recycling

3-Step Approach:

- Advanced Data Vault – Expand design leveraging UCIC to accommodate future enrichment with additional attributes, adding masking capabilities and enabling features as profile recycling. Ensured PCI, PII compliance with this added system design.

- Advanced Integration – Post disclosure-consent-authorization, system channeled pre-approved applicants through advanced integration points covering Risk, Fraud & Creditworthiness. Namely, complete I.D., Address, automated income verifications, encrypted access to financial accounts as well as obtaining credit reports from Bureaus. This successfully builds a profile docket for underwriting and decision analysis.

- Credit Decision – Post underwriting review, this is a

multi-option workflow split in four:

- Approval as offered – Generate OCR capable Contract, Loan disclosure, Amortization schedule, Banking info forms all integrated with Document management solution for binding e-signatures, encrypted communication and agreement.

- Modified Offer – Using pre-established secured communication protocols, sending encrypted correspondence for revised offer for acceptance.

- RFI (Request for Information) – Underwriting being the most critical component of lending had to be equipped for manual intervention for investigated approvals. Existing electronic communication protocols enables continued correspondence, attachments and attestations

- Rejection – Adverse action notification compliant communication is sent using pre-defined protocols.

In compliance with PCI, PII, FCRA, ECOA, FATCA, phase 2 uses several sub-components for facilitation. OTP system with transactional SMS, Digital Signatures, E-Stamps, Electronic payment support, Document management, Payment gateways, unified web/mobile platforms as well as compliant in-house Data Vault for information management, reporting and enrichment purposes.

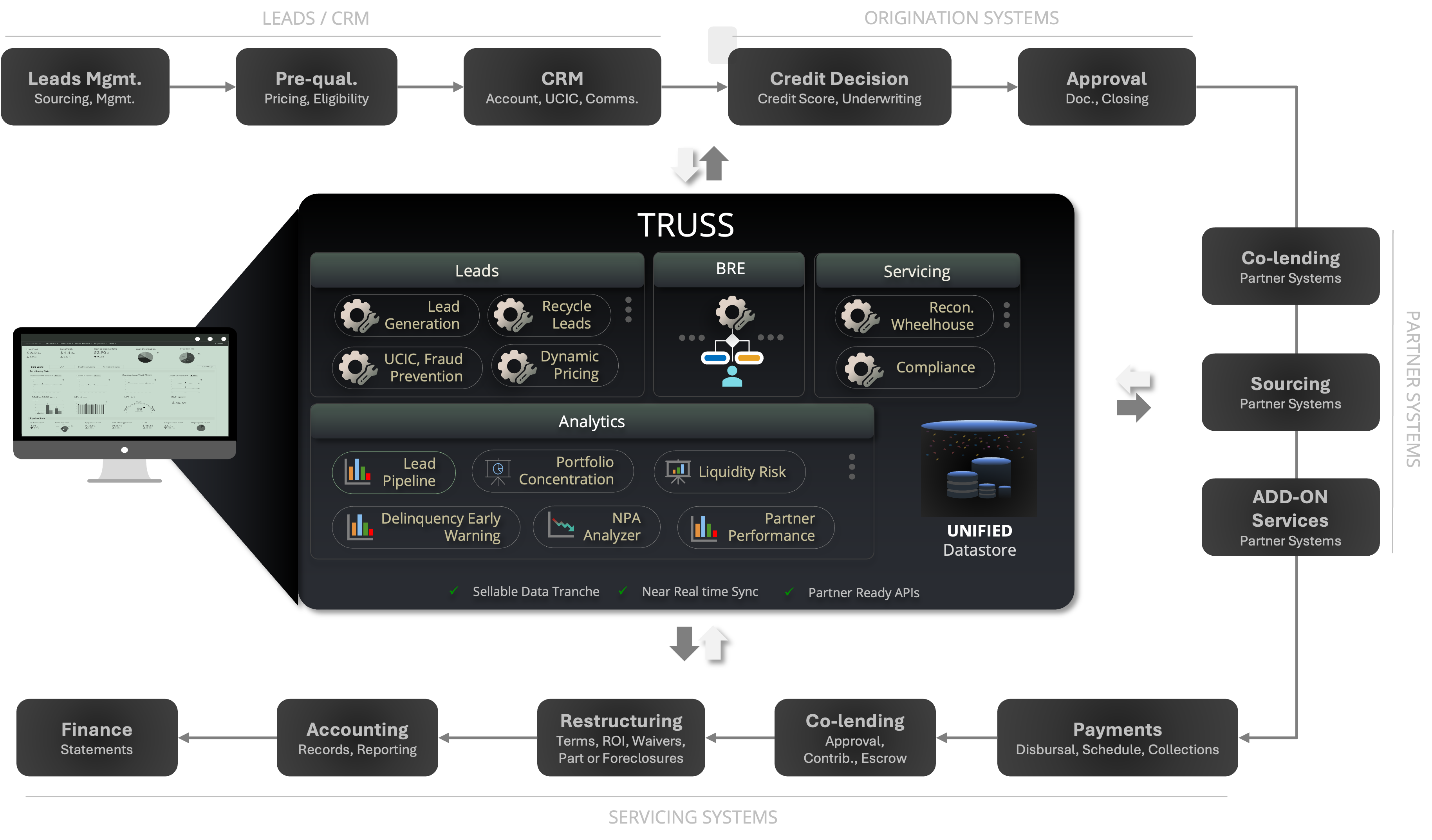

Post-LMS Analytics, Risk & Leverage; Feeding near real-time from Data Vault for defined indicators for growth and risk management. Leveraging Data Vault capabilities for Syndication opportunities.

Phase 3 was designed for:

- Synthesizing built collateral; define, measure & monitor functional workflows

- Enable Syndication leveraging UCIC & Data Vault

- Establish Framework for Ancillary revenue through Channel Partnerships

3-Step Approach:

- Mapping, Monitoring, BPM – System was now touching upon

external, internal interfaces, marketplaces, collecting PII, integrating with key Risk

evaluation partner systems for decision-making and enabling external electronic communication.

This coverage had to vetted for Compliance, Security and Performance.

Hence, it was critical to take stock of all touchpoints, partition functional workflows, match current compliance practices across these sub-systems and stress test as a whole. Second, was to have monitoring coverage on 80% of functional workflows, in first 90-days. Thereby, plot entire applicant journey and monitor performance internally and on dependencies.

- Syndication – With tracing capabilities (UCIC) in place, banking syndication vertical was executed. This allowed several banks to co-lend into vetted applicants. From docket notification, participation confirmation, margin funding, disbursement and periodic repayment splits were seamlessly facilitated. Single handedly, Syndication banks bumped the company IRR more than 2.3x.

- Ancillary Revenue – Data Vault enrichment led to unchartered revenue verticals. Recycling inactive lead and existing customers for additional financing or cross-selling. This was achieved by whitelisting them using soft credit check APIs layered with insights from analytics on historical data. The next evolution was to monetize Data Vault. Using similar Syndication workflows, profile database was being catered for selective consumption across channel partners. Namely, Banking, Credit Cards, Insurance, etc. This was achieved via direct ingestion of UCIC tagged structured leads into partner CRM systems. Monthly automated reconciliation module eliminated delays, provided transparency as well as seamless disbursement reconciliations toward each other.